Degree of Operating Leverage Calculator + Formula

If all goes as planned, the initial investment will be earned back eventually, and what remains is a high-margin company with recurring revenue. In this best-case scenario of a company with a high DOL, earning outsized profits on each incremental sale becomes plausible, but this type of outcome is never guaranteed. When a company’s revenue increases, having a high degree of leverage tends to be beneficial to its profit margins and FCFs. Suppose the operating income (EBIT) of a company grew from 10k to 15k (50% increase) and revenue grew from 20k to 25k (25% increase). Welcome to the fascinating world of the Degree of Operating Leverage (DOL)! If you’re eager to understand how changes in sales impact your operating income, you’re in the right place.

- In contrast, a computer consulting firm charges its clients hourly and doesn’t need expensive office space because its consultants work in clients’ offices.

- Use the calculator to pinpoint cost control opportunities and streamline your operations.

- This guide will walk you through the ins and outs of using the Degree of Operating Leverage Calculator, all while keeping things engaging and lighthearted.

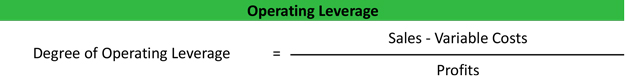

- The Degree of Operating Leverage (DOL) measures how a company’s operating income responds to changes in sales.

- If sales revenues decrease, operating income will decrease at a much larger rate.

How it Calculates:

This can reveal how well a company uses its fixed-cost items, such as its warehouse, machinery, and equipment, to generate profits. The more profit a company can squeeze out of the same amount of fixed assets, the higher its operating leverage. The formula can reveal how well a company uses its fixed-cost items, such as its warehouse, machinery, and equipment, to generate profits. Here’s how you can use an Operating Leverage Calculator to understand how your company’s fixed and variable costs impact profitability. If a company has low operating leverage (i.e., greater variable costs), each additional dollar of revenue can potentially generate less profit as costs increase in proportion to the increased revenue. To lower your DOL, consider reducing fixed costs, increasing variable costs, or adjusting your cost structure to make it more flexible in response to sales changes.

What are the limitations of using DOL?

If you’re still having problems calculating the DOL of your business, you can always use our degree of operating leverage calculator and other helpful tools on CalcoPolis. The calculator works out both the degree of operating leverage (DOL) and the operating leverage, and allows for details relating to two businesses or accounting periods to be entered so that comparisons can be made. By calculating the DOL, you can identify areas where cost reductions can have the most significant impact on profitability.

Telecom Company Example

Revenue and variable costs are both impacted by the change in units sold since all three metrics are correlated. Therefore, each marginal unit is sold at a lesser cost, creating the potential for greater profitability since fixed costs such as rent and utilities remain the same regardless of output. The more fixed costs there are, the more sales a company must generate in order to reach its break-even point, which is when a company’s revenue is equivalent to the sum of its total costs. DOL measures how sales changes affect operating income, while financial leverage measures the impact of debt on earnings per share. In most cases, you will have the percentage change of sales and EBIT directly. The company usually provides those values on the quarterly and yearly earnings calls.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. For comparability, we’ll now take a look at a consulting firm with a low DOL.

What Is the Difference Between Operating Leverage and Financial Leverage?

A low DOL, on the other hand, suggests that a company’s variable costs are higher than its fixed costs. This means that changes in sales have a less dramatic impact on operating income. Companies with low operating leverage experience smaller fluctuations in EBIT with changes in sales.

The calculator will reveal that the Degree of Operating Leverage (DOL) for this scenario is 2. This means that a 1% change in sales will result in a 2% change in operating income. Analyzing operating leverage helps managers assess the impact of changes in sales on the level of operating profits (EBIT) of the enterprise. Higher DOL means higher operating profits (positive DOL), and negative DOL means operating loss. The degree of operating leverage (DOL) measures how much change in income we can expect as a response to a change in sales.

This leverage can be advantageous during periods of rising sales but poses higher risks during downturns. To elaborate, it measures how much a company’s operating income will change in response to a change that’s particular to sales. On the other hand, a low DOL suggests that the company has a low proportion of fixed operating costs compared to xero band its variable operating costs. This means that it uses less fixed assets to support its core business while sustaining a lower gross margin. Scenario planning becomes more straightforward with the DOL calculator at your disposal. Assess different scenarios by adjusting sales volumes and costs to see how your operating income would be impacted.