The Journal Entries when Shares are Purchased and Brokerage and Other Expenses are Paid Accounting Education

Two common accounts in the equity section of the balance sheet are used when issuing stock—Common Stock and Additional Paid-in Capital from Common Stock. Common Stock consists of the par value of all shares of common stock issued. Additional paid-in capital from common stock consists of the excess of the proceeds received from the issuance of the stock over the stock’s par value. When a company has more than one class of stock, it usually keeps a separate additional paid-in capital account for each class. A small stock dividend occurs when a stock dividend distribution is less than 25% of the total outstanding shares based on the shares outstanding prior to the dividend distribution.

Accounting for a Stock Split

It can be a strategic maneuver to prevent another companyfrom acquiring a majority interest or preventing a hostiletakeover. A purchase can also create demand for the stock, which inturn raises the market price of the stock. Sometimes companies buyback shares to be used for employee stock options or profit-sharingplans. Sometimes a corporation decides to purchase its own stock in the market. A company might purchase its own outstanding stock for a number of possible reasons.

Typical Common Stock Transactions

When a company issues stock for property or services, thecompany increases the respective asset account with a debit and therespective equity accounts with credits. When a company issues stock for property or services, the company increases the respective asset account with a debit and the respective equity accounts with credits. When a company issues new stock for cash, assets increase with a debit, and equity accounts increase with a credit. To illustrate, assume that La Cantina issues how puerto ricans are fighting back against using the island as a tax haven 8,000 shares of common stock to investors on January 1 for cash, with the investors paying cash of $21.50 per share. The price paid in excess of the amount accounted for as the cost of the treasury shares shall be attributed to the other elements of the transaction and accounted for according to their substance. If no stated or unstated consideration in addition to the capital stock can be identified, the entire purchase price shall be accounted for as the cost of treasury shares.

Comparing Small Stock Dividends, Large Stock Dividends, and Stock Splits

Some companies issue shares of stock as a dividend rather than cash or property. This often occurs when the company has insufficient cash but wants to keep its investors happy. When a company issues a stock dividend, it distributes additional shares of stock to existing shareholders. These shareholders do not have to pay income taxes on stock dividends when they receive them; instead, they are taxed when the investor sells them in the future. Companies that do not want to issue cash or property dividends but still want to provide some benefit to shareholders may choose between small stock dividends, large stock dividends, and stock splits.

📹 Dive into the World of Accounting Education!

Both small and large stock dividends occur when a company distributes additional shares of stock to existing stockholders. A few months later, Chad and Rick need additional capital todevelop a website to add an online presence and decide to issue all1,000 of the company’s authorized preferred shares. The Cash accountincreases with a debit for $45 times 1,000 shares, or $45,000. ThePreferred Stock account increases for the par value of thepreferred stock, $8 times 1,000 shares, or $8,000.

- Auditor’s statement is required that they have enquired into the company’s state of affairs.

- In order to know how you should be entering this money movement to represent the purchase of shares, I recommend reaching out to your accountant.

- Additionally, it provides detailed guidance for legal and taxation aspects, template resolutions.

- The excess of the issue price of $45 per share over the $8 par value, times the 1,000 shares, is credited as an increase to Additional Paid-in Capital from Preferred Stock, resulting in a credit of $37,000.

- Purchase of stock investment provides two main benefits to the company, in which the first one is that it can earn the dividend revenue from the investment.

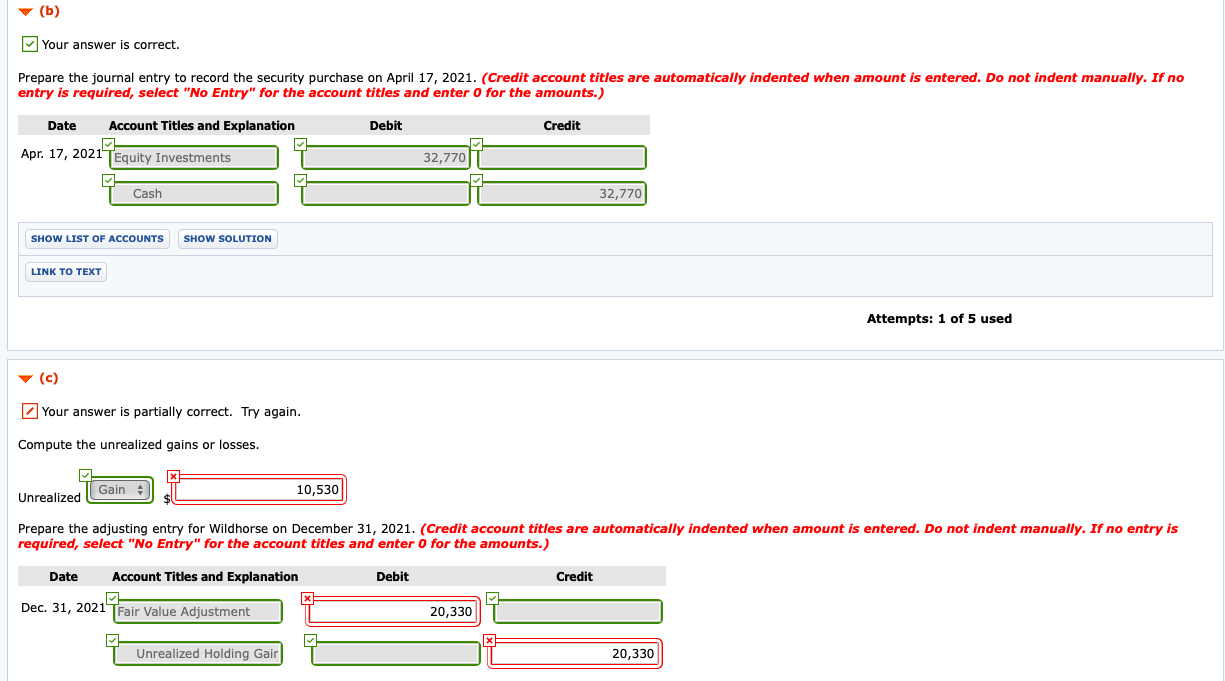

A purchase of own shares, also known as a share buyback, may have tax advantages for a shareholder who wants to reduce or end their shareholding in a company. A company’s decision on whether to undertake a reduction of share capital or a share buy-back is often driven in part by tax considerations. If, instead, the fair value at year-end had been only $21,000, a $4,000 unrealized loss will appear on Valente’s income statement to reflect the decline in value ($25,000 historical cost dropping to $21,000 fair value). The Walt Disney Company hasconsistently spent a large portion of its cash flows in buying backits own stock.

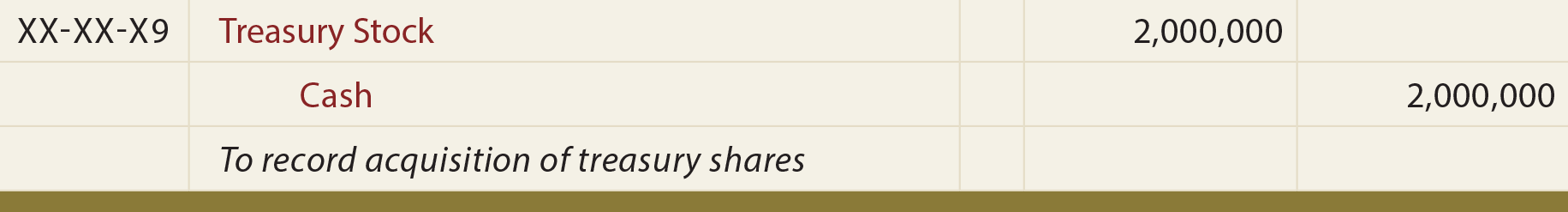

Notice on the partial balance sheet that the number of common shares outstanding changes when treasury stock transactions occur. Initially, the company had 10,000 common shares issued and outstanding. The 800 repurchased shares are no longer outstanding, reducing the total outstanding to 9,200 shares. The company can record the purchase of treasury stock with the journal entry of debiting the treasury stock account and crediting the cash account.

The key difference is that small dividends are recorded at market value and large dividends are recorded at the stated or par value. The date of payment is the third important date related to dividends. This is the date that dividend payments are prepared and sent to shareholders who owned stock on the date of record.